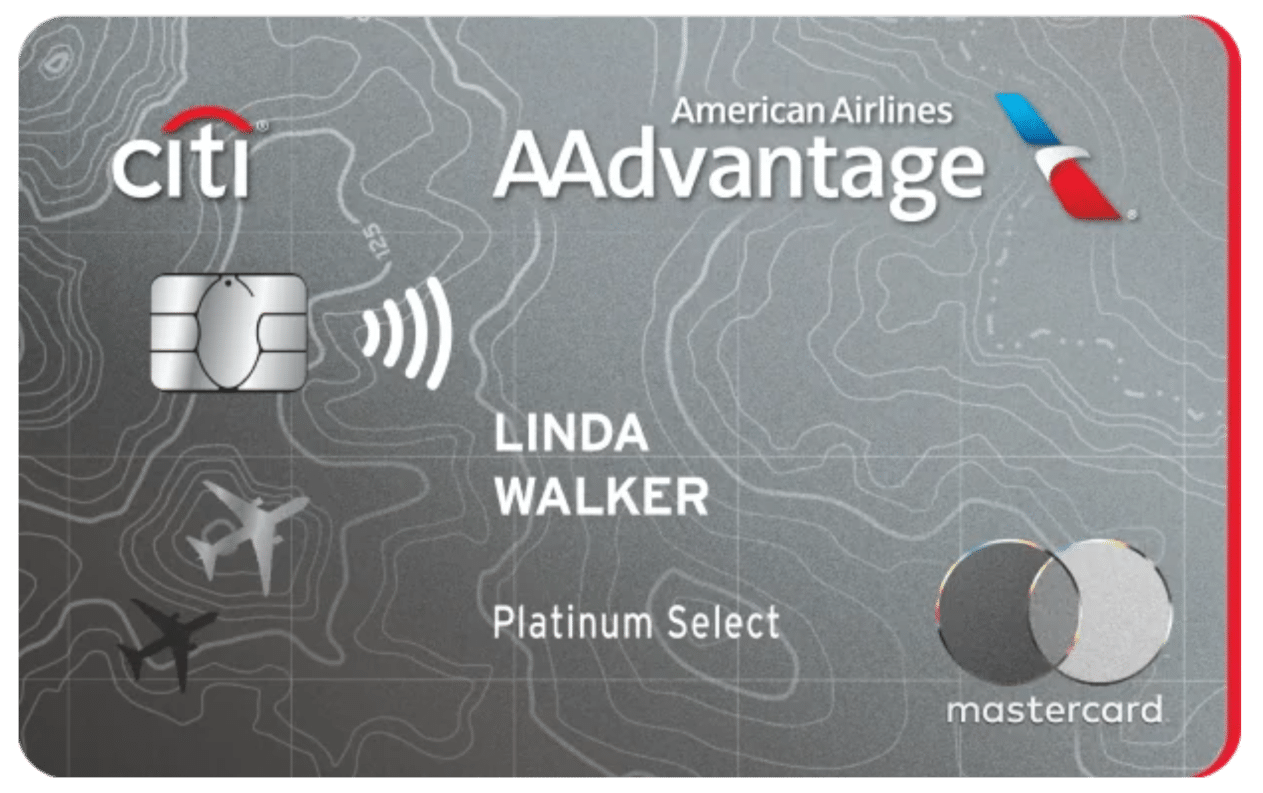

Citi® AAdvantage® Platinum Select® Credit Card

Maximize travel rewards with the Citi® AAdvantage® Platinum Select® Credit Card!

Anúncios

Citi® AAdvantage® Platinum Select® Credit Card

Earn Miles on Every Dollar Spent First Checked Bag FreeFor frequent flyers and avid travelers, finding the perfect credit card to match their lifestyle can be challenging.

The Citi® AAdvantage® Platinum Select® Credit Card stands out as a top choice for those looking to earn American Airlines miles while enjoying valuable travel perks.

With a combination of generous rewards, exclusive benefits, and cost-saving opportunities, this card is tailored for those who love exploring the world.

Anúncios

Whether you’re planning a dream vacation or simply want to enhance your everyday spending with miles, the Citi® AAdvantage® Platinum Select® is a card worth considering. Let’s dive into why it deserves a spot in your wallet.

Key Benefits of the Citi® AAdvantage® Platinum Select® Credit Card

- Earn Miles on Every Dollar Spent: With this card, you earn 2 AAdvantage® miles per dollar spent on eligible American Airlines purchases, restaurants, and gas stations. Plus, you’ll earn 1 mile per dollar on all other purchases, making every transaction count toward your next adventure.

- First Checked Bag Free: Save up to $140 per round trip for you and up to four companions on the same reservation. This feature alone can quickly offset the annual fee, making it a favorite among frequent flyers.

- Preferred Boarding on American Airlines Flights: Skip the lines and board earlier with preferred boarding, ensuring you have space for your carry-on and a stress-free start to your journey.

- No Foreign Transaction Fees: Travel internationally without worrying about extra fees. Enjoy seamless spending abroad and focus on experiencing your destination instead of hidden costs.

Drawbacks to Consider

While the Citi® AAdvantage® Platinum Select® Credit Card has many advantages, there are a few points to keep in mind:

Anúncios

- Annual Fee: The card comes with a $99 annual fee, waived for the first year. If you’re not a frequent traveler, the fee may outweigh the benefits.

- Limited Reward Redemption: Miles are best used for American Airlines flights, which may limit their value if you prefer other airlines.

- No Travel Insurance Perks: Unlike some premium travel cards, this one lacks comprehensive travel protection benefits.

Who Should Consider the Citi® AAdvantage® Platinum Select® Credit Card?

This card is ideal for frequent American Airlines flyers who want to earn miles effortlessly and enjoy perks like free checked bags and priority boarding.

It’s also a smart choice for those who dine out often or commute by car, as it offers bonus miles for restaurant and gas station purchases.

If you’re looking for a cost-effective way to enhance your travel experience while earning rewards, the Citi® AAdvantage® Platinum Select® Credit Card strikes a great balance between affordability and benefits.

Unlock the Sign-Up Bonus for a Head Start on Travel

One of the standout features of the Citi® AAdvantage® Platinum Select® Credit Card is its lucrative sign-up bonus.

New cardholders can earn a substantial amount of bonus AAdvantage® miles by meeting the initial spending requirement within the first three months.

This bonus can often cover the cost of a domestic or even international flight, giving you a fast-track opportunity to put your miles to good use.

Whether you’re booking a family vacation or a solo getaway, this bonus makes it easier to save on travel expenses right from the start. Don’t miss this chance to kickstart your rewards journey!

Summary of Pros and Cons

Pros:

- Generous AAdvantage® mile earning potential.

- Free first checked bag for up to five passengers.

- No foreign transaction fees for global travelers.

- Priority boarding for convenience.

Cons:

- $99 annual fee after the first year.

- Limited redemption options for non-AA travelers.

- Lacks premium travel insurance benefits.

Why We Recommend the Citi® AAdvantage® Platinum Select®

The Citi® AAdvantage® Platinum Select® Credit Card is more than just a rewards card; it’s a gateway to smoother and more affordable travel.

From earning miles on everyday purchases to enjoying airline perks like free checked bags, this card provides significant value to frequent American Airlines flyers.

If you’re ready to elevate your travel game, this card is a fantastic choice. Click below to learn more and apply today—your next adventure awaits!

You will remain on this website.